Estates tax & Planning

Trusts & estates Planning How to help your clients avoid unpleasant surprises.

You may find yourself in the role of trustee or an executor without preparation or during a stressful life event, like the death of a loved one. Chartered Professional Accountant at Hongo Tsuji Tx & consulting are here to help you understand how the tax law applies to your situation and give you peace of mind as you handle the affairs of the estate or trust.

Effective estate planning facilitates the orderly transfer of assets to your beneficiaries, provides security for your surviving family, and can reduce or eliminate the tax due on the transfer of your assets. A well-executed estate and trust plan will facilitate a well-organized transfer of assets.

At Hongo Tsuji Tx & consulting, we can guide you through the complex process of getting your financial affairs in order and help you to design your estate in a way that protects your wealth while also ensuring that your business, and other assets, are transferred to your intended beneficiaries, with minimal tax liabilities.

How can Hongo Tsuji Tax & consulting Can Help You?

We has the expertise to properly prepare and file income tax returns for estates and trusts. However, tax returns are only one piece of the planning process. At We, our highly qualified CPAs will work with you to achieve and manage your financial goals while helping to develop a clear plan for today and beyond.

Our Chartered Professional Accountant has years of experience with tax returns for estates and trusts, which has enabled us to develop a trusted process that eases estate preparation. We stay up-to-date on the legislation, tax rulings, and other matters of interest that pertain to estate planning, helping you structure an estate plan that:

・Provide a customized strategy that fits your objectives

・Facilitates the orderly transfer of your assets

・Analyze estate liquidity

・Minimizes taxes levied on your donation bequests and estate

・Maximize tax savings while balancing the financial needs of your family

・Addresses tax issues connected to a trust

・Determines rollover of property to beneficiaries or a trust

Estate Tax Preparation

Most likely, you’ll only be an executor or personal representative of an estate once or twice in your lifetime. It is an overwhelming task to understand which tax filings are needed and how handling the estate will impact the heirs.

We will help you through the tax process and give you peace of mind as you handle the affairs of the estate or trust.

Large estates are required to file a tax return that lists all the assets of the estate.

These assets include bank accounts, stocks, real estate, IRAs, pensions, annuities and the like. This is called “Estate Tax Return”.

Some estates may also need to file a tax return that reports the income earned from the date of death to the date assets are distributed to the heirs. The beneficiaries will pay the tax.

The estate must also prepare a final individual income tax return. This return reports the income earned from January 1st until the date of death.

It can be challenging to know exactly how to handle certain types of income on the final return.

We will evaluate your unique situation to determine which filings are needed and accurately prepare the returns.

A Wide Scope of Tax payer

If you will be in situations where family members and estates span multiple countries and tax jurisdictions, the differences between each area’s laws can lead to complicated inheritance or estate tax and gift tax issues.

Japanese inheritance and gift tax regulations mean that taxpayers often fall within their scope without being aware of their position. These taxpayers are those with a residence in Japan and can include senior executives, entrepreneurs and those in international marriages expats, in addition, foreign nationals with no residence in Japan who have diversified into stocks of Japanese companies or real estate here also face a possible liability.

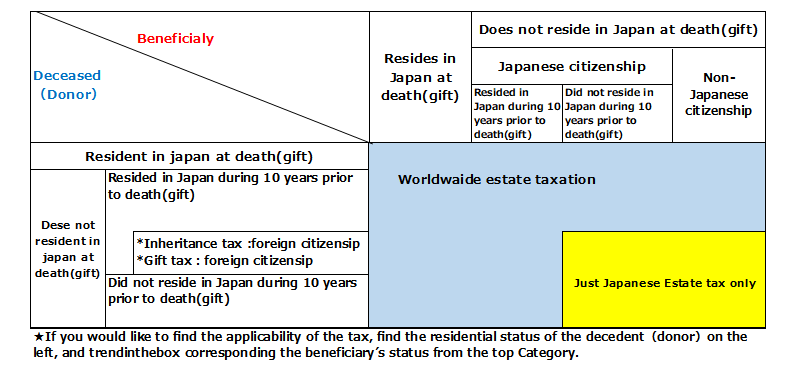

★Which assets do Japanese inheritance tax and gift tax apply?

The Types of Estate and Trust Tax Services we Provide include:

・Charitable Trust Income Tax Preparation

・Simple and Complex Income Tax Preparation

・Special Needs Trust Income Preparation

・Qualified Disability Trust Income Preparation

・Estate Income Tax Preparation

・Estate Tax Returns

・Gift Tax Returns

Our company’s members can prepare the tax returns and give suggestions on strategies that focus on tax-efficient allocation of income and principal by trusts and estates, even if you already have a lawyer who is handling the administration of the trust or estate. We collaborate with attorneys to ensure that your estate or trust is being managed in a manner that is most beneficial for your goals and circumstances.

Estate Tax Return Preparation and Filing

Hongo Tsuji Tx & consulting, is well versed in preparing estate tax returns, when required. Our years of experience in the preparation of fiduciary income tax returns, trust and probate court accounting and post mortem estate planning that can significantly save your estate tax burdens.

(In some case, for both federal and state tax in U.S.)

Working with your Advisors

Professional teamwork is important. Executors, beneficiaries, attorneys and investment advisors look to us for fiduciary income tax and estate tax planning and preparation, and we work in collaboration with them. Trusts and estates often involve complex tax issues, and there simply is not a substitute for experience. Our experience will help guide you through the difficult task of calculating and reporting trust income to beneficiaries.

Partnering with Lawyers

we’re collaborative and enjoy partnering with attorneys to help your clients file estate tax returns with confidence. We’re experienced in estate tax law, but don’t have to cover the overhead costs for a national or regional firm. Instead, we offer flexibility and personal attention you often cannot find elsewhere.

If you’re a new or established attorney looking for a CPA partnership, please contact us to learn more about how we can help.